Predicting long-term deposit customers using convolutional neural network and data conversion technique

Keywords:

Machine Learning, Banking, CNN, Deep learning, MarketingAbstract

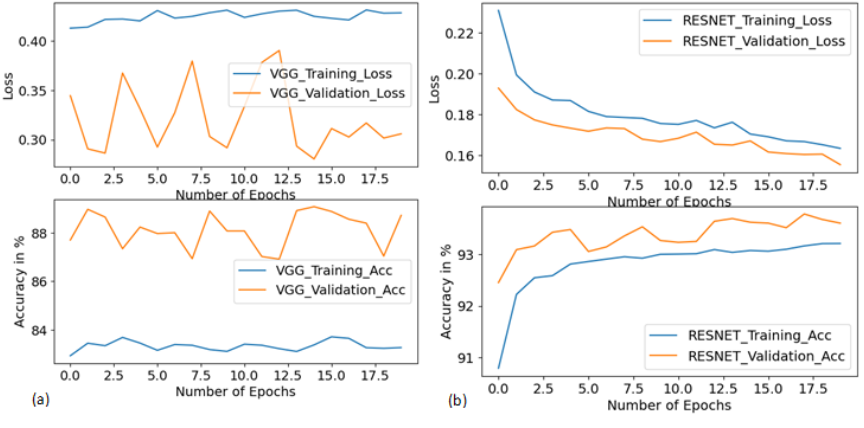

The banking industry is the foundation of any nation’s economy, and bank deposits are its primary source of profitability. Bank deposits play a significant role in determining a nation’s saving rate. Globalization has resulted in substantial technological changes, business strategy, and customer service across many industries, including the financial services sector. This study proposes a deep learning model using Residual Network architectural design and transfer learning on a Portuguese banking institution containing 40,811 training data, with 36,202 belonging to label 0 and 4639 belonging to label 1. Clearly, this shows a significant level of bias between the two labels. Hence, a SMOTE method of class balancing was applied. This dataset, in comma-separated value (CSV), was converted into images coupled with the weight transfer from the residual network trained on ImageNet; our fully connected layer was built and trained with the image files. The highest performance reached by the conventional machine learning models, Random Forest (RF), is 90.78% for accuracy, 59.37% precision, 96.78% recall, and 85.28% F1 score, tested on 412 test samples. However, our proposed methodology achieves an outstanding result with an accuracy of 93.00%, 97.00% precision, 90.00% recall, 93.00% F1 score, and 94.00% ROC, with test samples of size 5601. Since long-term deposits are necessary for the banking system to fund the individual, corporate, and industrial loans needed for the country’s growth and development, these results will provide an effective and reliable marketing technique required to determine the target population.

Published

How to Cite

Issue

Section

Copyright (c) 2024 Adebayo Abdulganiyu Keji, Oluwafemi Fakeye, Nneka N. Onochie, Olumide Sangotoki

This work is licensed under a Creative Commons Attribution 4.0 International License.

How to Cite

Similar Articles

- O. B. Ayoade, M. O. Raji, A. A. Akindele, K. J. Yusuf-Mashopa, M. F. Abdulrauf, I. A. Raji, F. B. Musah, Hyperparameter optimisation for support vector machine-based disease detection in maize leaf variants , African Scientific Reports: Volume 4, Issue 3, December 2025

- Adenike Adegoke-Elijah, Theresa Omolayo Ojewumi, Kudirat Oyewumi Jimoh, ECG anomaly detection: a deep learning perspective with LSTM encoders , African Scientific Reports: Volume 4, Issue 3, December 2025

- Gabriel James, Anietie Ekong, Aloysius Akpanobong, Enefiok Etuk, Saviour Inyang, Samuel Oyong, Ifeoma Ohaeri, Chikodili Orazulume, Peace Okafor, Enhanced machine learning model for classification of the impact of technostress in the COVID and post-COVID era , African Scientific Reports: Volume 4, Issue 1, April 2025

- Gabriel James, Anietie Ekong, Etimbuk Abraham, Enobong Oduobuk, Nseobong Michael, Victor Ufford, Oscar Ebong, An enhanced control solutions for efficient urban waste management using deep learning algorithms , African Scientific Reports: Volume 3, Issue 3, December 2024

- Osowomuabe Njama-Abang, Denis U. Ashishie, Emmanuel A. Edim, Moses A. Agana, Development of a visual analogy model using transfer learning techniques , African Scientific Reports: Volume 4, Issue 3, December 2025

- Denis U. Ashishie, Endurance O. Obi, Osowomuabe Njama-Abang, Ahena I. Bassey, Transformative approach in Lassa fever diagnostics: an innovative integrative strategy for early detection and outcome prediction , African Scientific Reports: Volume 4, Issue 3, December 2025

- Ignatius Nwoyibe Ogbaga, Henry Friday Nweke, Persuasive power of artificial intelligence-generated ads: exploring online behaviour among Gen Z internet users in Nigeria , African Scientific Reports: Volume 4, Issue 3, December 2025

- A. I. Bassey, M. A. Agana, E. A. Edim, O. Njama-Abang, Intrusion detection in a controlled computer network environment using hybridized random forest and long short-term memory algorithms , African Scientific Reports: Volume 4, Issue 3, December 2025

You may also start an advanced similarity search for this article.